5-minute read

Is the insurance industry’s “hard market” coming to an end?

After roughly five years of insurance premium increases across most lines of coverage, the best and most accurate response to that question is … it depends.

It depends, specifically, on the line of coverage you’re buying, not to mention your industry and, as always, your location.

A soft market, sometimes called a buyer’s market, is characterized by stable or even declining premiums, broader terms of coverage, increased capacity, higher available limits of liability, easier access to excess layers of coverage and competition among insurance carriers for new business.

A hard market is characterized by rising premiums, stricter underwriting criteria, less capacity, restricted terms of coverage and less competition among insurance carriers.

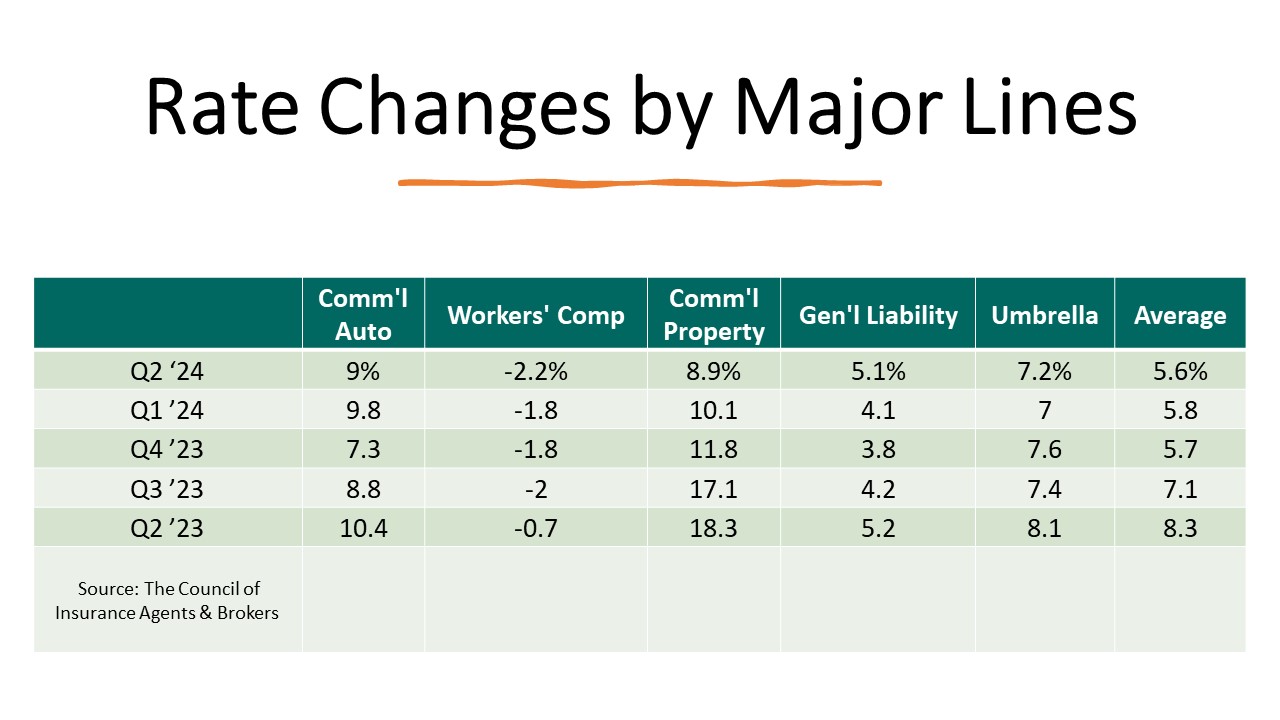

We’ve been in a hard market since about 2019. But now, the latest Council of Insurance Agents and Brokers (CIAB) insurance market report, covering the second quarter of the year, has found signs of softening.

Premiums increased by an average of 5.2% across all account sizes – meaning small, medium and large – in the quarter, the CIAB’s report said.

That’s up, of course, but it’s down from the previous quarter’s increase of 7.7%.

That’s up, of course, but it’s down from the previous quarter’s increase of 7.7%.

Medium-sized account premium increases slowed the most, falling from 8.5% in Q1 to 5.1% in Q2.

Better still, four lines of coverage recorded premium decreases in the quarter: workers’ compensation, cyber, directors and officers, and employment practices liability.

Notably, cyber premiums saw an average decline of -1.7% in the period, a stark contrast to just two years ago, when cyber insurance saw increases of over 20% for a number of consecutive quarters.

CIAB said that increased capacity for the line – meaning more competition – may have contributed to this decrease in premiums.

On the flip side of things, commercial auto premiums rose the most in the quarter, climbing 9%. That’s hardly a surprise given the rise of distracting driving and expense of getting a car back on the road after a wreck.

Right behind auto was commercial property’s 8.9% average increase.

While still hefty, the CIAB noted those increases were lower than Q1’s 9.8% and 10.1%, respectively.

Property owners with no losses and a robust safety culture are faring best nowadays. Those in regions prone to hurricanes or wildfires are, perhaps understandably, not.

Insurance premiums are influenced, of course, by myriad factors. These include natural disasters, outsized jury verdicts, mixed investment results and inflation, which drives up the cost of materials needed to rebuild homes and businesses ravaged by fire or floods.

So, are we at the start of a softening market that won't turn back? Hard to say, because while inflation has dropped considerably and Wall Street’s bull market remains strong, there’s no telling what Mother Nature might unleash. Also, those multimillion-dollar “nuclear” verdicts we keep seeing aren't likely to go away anytime soon.

Tips for Insurance Buyers

It can sometimes seem as if the forces determining your insurance rates are beyond your control. But, as an insurance buyer, it’s important to know a solid risk management plan will help steer your pricing in a more favorable direction, both now and in future renewal periods. With that in mind, here are a few tips for property coverage buyers:

- Work with your insurance professionals to begin the renewal process early. Many commercial property insurers are seeing an increased submission volume. Timely, complete and quality submissions are vital to ensure your application will be reviewed by underwriters.

- Determine whether you will need to adjust your business’ retentions or limits to manage costs.

- Gather as much data as possible regarding your existing risk management techniques. Be sure to work with your insurance professionals to present loss control measures you have in place.

- Conduct a thorough inspection of both your commercial property and the surrounding area for specific risk management concerns. Implement additional mitigation measures as needed.

- Analyze your organization’s natural disaster exposures. If your commercial property is located in an area prone to a specific catastrophe, implement mitigation and response measures (e.g., install storm shutters on windows to protect against hurricane damage, or utilize fire-resistant roofing materials to protect against wildfire damage) to protect your property as much as possible.

- Develop a documented business continuity plan (BCP) that will help your organization remain operational and minimize damages in the event of an interruption. Test this BCP regularly with various possible scenarios. Make updates when necessary.

- Address insurance carrier recommendations. Insurers will be looking at your loss control initiatives closely. Taking the appropriate steps to reduce your risks whenever possible can make your business more attractive to underwriters.

The Mahoney Group, based in Mesa, Ariz., is one of the largest independent insurance and employee benefits brokerages in the U.S. For more information, visit our website or call 877-440-3304.